More than 20mn United kingdom homes are facing a 54 for every cent increase in electrical power costs from Friday and benefits will drop in genuine conditions as financial data show surging inflation strike customer paying even just before the outcomes of Russia’s invasion of Ukraine were being felt.

Power costs for the 22mn households whose payments are capped will increase by an ordinary of £693 to £1,971 a 12 months from April 1 to reflect surging fuel and oil rates.

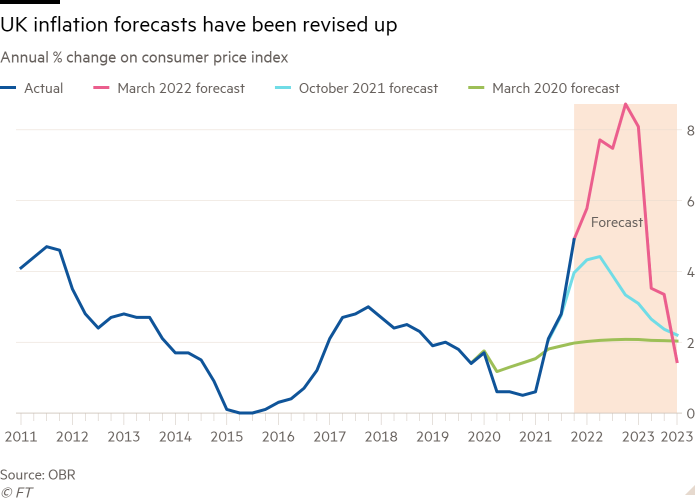

At the exact same time, universal credit, the most important welfare payment, and the condition pension are becoming enhanced by just 3.1 for each cent. This is a lot less than fifty percent the pace of inflation anticipated in the second quarter by the Business office for Budget Responsibility, the impartial fiscal watchdog.

The changes occur as official knowledge published on Thursday confirmed a drop in households’ genuine earnings, shrinking personal savings and decreased progress in investing at the stop of very last year.

Surging selling prices will add to households’ genuine profits slipping this calendar year at the swiftest rate due to the fact data began in the 1950s, in accordance to the OBR, as government help measures have offset only all over a third of the drop in dwelling criteria.

Gurus warned that surging costs will result in both gasoline and complete poverty growing. The Resolution Foundation, a consider-tank, revealed on Friday that the amount of English homes in gas strain will double from 2.5mn to 5mn as a final result of the cost cap enhance.

The consider-tank observed that one more 2.5mn homes are at possibility of gasoline poverty in October if the price tag cap rises all over again to £2,500, £300 fewer than the OBR forecast it could. Countrywide Electricity Motion, the main gas poverty charity, recently released equivalent figures.

Jonathan Marshall, senior economist at the Resolution Basis, explained the rise in electricity payments “hastens the have to have for far more instant support” for homes. He additional that the authorities also required a long-phrase system for enhancing household insulation, ramping up renewable and nuclear electricity era, and reforming power marketplaces so that consumers’ charges are fewer dependent on global gas rates.

The Resolution Basis also believed that 1.3mn persons will be pushed into complete poverty subsequent yr as a outcome of the price tag of dwelling crisis, including 500,000 children.

Frances O’Grady, standard secretary of the Trades Union Congress, symbolizing the vast majority of unions, explained the government’s Spring Statement previous week was “woefully inadequate”, and referred to as on chancellor Rishi Sunak to current an crisis Funds.

“People should not be struggling to address the fundamentals,” she said.

Energy bills are climbing as the ONS revealed that in the previous three months of 2021, true family disposable money fell by .1 per cent in contrast with the past quarter while home expenditure rose only .5 for every cent.

This was significantly considerably less than beforehand believed and a sharp slowdown from 2.6 per cent development in the previous a few months, signalling that the momentum powering the shopper recovery experienced begun to falter at the conclude of previous calendar year.

This was regardless of gross domestic merchandise growth being revised up thanks to sturdy action in the well being sector.

Falling genuine incomes necessarily mean that households purchased a lot more goods and providers by minimizing their financial savings to keep the identical standard of living. The home saving ratio, the ordinary proportion of disposable cash flow that is saved, lowered to 6.8 for every cent in the final quarter of 2021, down from 7.5 for each cent in the prior 3 months and the cheapest due to the fact the start off of the pandemic.

Commenting on the ONS facts, Samuel Tombs, chief United kingdom economist at consultancy Pantheon Macroeconomics, said that “no one really should rule out a decrease in households’ authentic expenditure this calendar year that could drag the all round economy into a recession”.

Symptoms of belt-tightening have turn out to be apparent in facts covering the begin of this year as inflation climbed to a 30-calendar year large in February.

United kingdom client self esteem dropped to a 17-thirty day period minimal in March, actual wages contracted in the 3 months to January and retail income fell. To cope with mounting price ranges, British buyers are cutting on non-necessary paying out and strength use, in accordance to an ONS study revealed this week. But for numerous, that is not more than enough and Citizens Information, a charity, reported it had referred a history variety of men and women to food banking institutions or other charitable assistance this month.

Enterprises are also sensation the hit from reduced need and rising prices.

The British Chambers of Commerce, a business enterprise organisation, on Friday claimed that a file proportion of companies expected to elevate rates in the following three months.

Suren Thiru, head of economics at the BCC, explained: “Russia’s invasion of Ukraine has lifted the chance of a renewed economic downturn by aggravating the fiscal squeeze on companies and households and disrupting the supply of commodities to crucial sectors of the United kingdom economy.”

Further reporting from Nathalie Thomas