South Africa entered tough lockdown two decades ago on March 28. At the time, numerous believed it would last a couple of weeks or perhaps a couple months at most. As an alternative, the Covid-19 pandemic is still with us.

Go through:

Even though we are still striving to determine out the limited- and extensive-expression implications of the ongoing pandemic, we ought to now also contemplate how the brutal Russian invasion of Ukraine will change the international financial and political buy.

In other words, the world has confronted two profound crises in the house of two yrs. They will induce far-achieving change, but what specifically? Comprehension the current is really hard enough. Predicting the future is nicely neigh extremely hard.

A lot of commentary now talks about the planet splitting into two blocs, one particular led by America and a person by China (joined by Russia and other intolerant states).

In which South Africa would in shape in is unclear.

Neighborhood small business elites and the center course have a tendency to look West, but lots of political leaders seem East.

Experts analyze logistics

However, 1 probably consequence is an greater focus on resilience and safety of provide around speed, effectiveness and expense. Any one operating a company will assume diligently about in which vital inputs appear from, the risks of disruptions and ways desired to prevent disruption (governments are with any luck , performing the identical).

Shortages of laptop or computer chips have hobbled vehicle production above the previous 18 months, for instance, but much more lately German brands uncovered themselves small of a much a lot less subtle portion that is imported from Ukraine, the humble but very important wire harness.

Standard Omar Bradly, the American Earth War II hero, is stated to have pointed out that “amateurs talk tactics whilst professionals review logistics”.

Russia’s generals seem to be to have neglected that in arranging their invasion of Ukraine, with soldiers working out of meals and ammunition and tanks having stuck without having fuel, but business leaders will not want to be caught quick once again.

That claimed, a massive part of the pressure on international source chains remains the remarkable demand for products in contrast to the previous. This is one consequence of the pandemic that is continue to with us. Desire for merchandise, specifically by American shoppers, is however perfectly over pre-pandemic tendencies. Paying out on companies has recovered but not again to wherever it would have been in the absence of the pandemic. Noticed in this gentle, supply chains really executed remarkably properly to produce and ship document-breaking quantities of goods. But not properly sufficient to stay clear of shortages, huge price boosts and extended direct instances.

US shopper paying on goods and products and services, rebased

Source: Refinitiv Datastream

Neither of these two worldwide crises is around.

China has yet again resorted to challenging lockdowns to limit the unfold of the virus. But in most other nations around the world it has luckily develop into background sounds many thanks to common vaccination, immunity from prior an infection, far better therapy options, significantly less severe strains and, frankly, men and women simply seeking to get on with their lives. Irrespective of whether we are actually at the conclusion of the pandemic continues to be to be found, but there is motive to be optimistic.

China’s difficult lockdowns of main cities together with Shanghai and Shenzhen will incorporate further more pressure to offer chains.

China is the world’s manufacturing unit and will remain so for a extended time even if corporations commence diversifying away from a country in which policy has develop into considerably less predictable and geopolitics more uncertain.

The war in Ukraine also rages on with no instant end in sight, even if Russia looks to have provided up some of its primary war aims. The market response – with equities up since the first days of the invasion – seems to propose that traders believe that the worst-case eventualities are significantly less likely.

The Fed shifts

Having said that, in the qualifications a different important change is underway.

Central banking companies, led by the US Federal Reserve, have turned hawkish, indicating they want to act to tame higher inflation.

The Fed’s most popular inflation gauge hit a four-ten years high of 6.4% in February. Although gasoline selling prices are element of the tale, core inflation excluding food stuff and gasoline was at 5.4%. In the Eurozone, inflation hit 7.5% in March, the best since the development of the one forex in 1999. The strength value spike has played a bigger position in Eurozone inflation than in the US, but core inflation even so hit a report 2.9%.

Confronted with historically large inflation and traditionally minimal unemployment costs, central financial institutions are set to go on tightening coverage in spite of the more and more uncertain advancement outlook. For most of the past 14 a long time, central banks, particularly the Fed, experienced been witnessed as investors’ pals. This was specifically genuine two yrs in the past when they unleashed unimagined stimulus in response to the Covid shock.

No more. What lies in advance will ever more be a trade-off between sustaining growth and reducing inflation. All indications are that the Fed and firm will now concentrate on the latter.

No quarter specified

Despite desire amount hazard, most important worldwide fairness benchmarks ended up constructive in March, with China staying a notable exception. Nonetheless, the initial quarter return from worldwide equities was decidedly detrimental. Apart from the shock of war, equity markets have had to discounted rising fascination rates.

The first quarter was even worse for bonds. Mounting fascination amount anticipations noticed yields jump. The benchmark US 10-year Treasury produce rose to 2.32% at the conclude of March obtaining commenced the yr at 1.4%. Shorter-phrase yields greater more quickly, major to a flattening yield curve. The US two-yr Treasury produce still ended the quarter at 2.28% getting started at .7%. Yields rose in other produced nations also, and the share of bonds with damaging yields has shrunk swiftly from a peak of $18 trillion bucks to reduced single digits.

The 8% appreciation of the rand in opposition to the dollar considering that the start out of the year has compounded the losses from world assets for South African traders.

Fortunately, South African bonds and equities ended up good, so a diversified portfolio would’ve held up reasonably perfectly.

The FTSE/JSE Capped SWIX returned 1.5% in March, 6.7% year-to-date and 20% in excess of a person 12 months. South African bonds returned 1.8% in the very first quarter irrespective of volatility in local yields and the major international bond market-off. The 12-month return of 12% is perfectly ahead of money.

Because bonds, equities and the currency have been buoyed by elevated commodity price ranges, they are all at threat ought to these rates tumble sharply.

A calendar year or three

If we glance at three-yr returns, masking the previous of the pre-pandemic days, the Covid-crash and recovery, and the Ukraine war, an fascinating photo emerges.

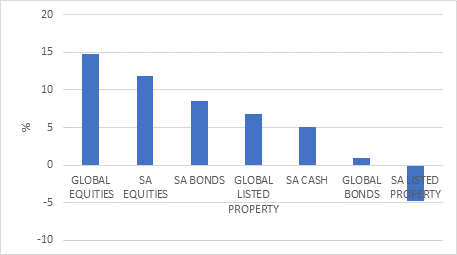

Three-calendar year annualised asset course returns in rand, %

Supply: MSCI, FTSE, JSE, Bloomberg, Refinitiv

International equities returned 14% for every calendar year around the past 3 decades in US dollars as measured by the MSCI All Country Globe Index. This is a remarkably very good end result presented the turmoil the international economic climate faced.

In terms of worldwide bonds, it is noteworthy that the ballyhooed increase in the benchmark US 10-12 months generate fairly considerably will take it back to the place it was a few many years back. The British isles equivalent is about 60 foundation factors higher than it was 3 yrs back. Germany’s now trades at .5%, whilst it was all over % in April 2019. It spent most of the subsequent a few yrs submerged under %.

Whereas world wide bond returns ended up amazing while yields ended up slipping, the modern rise in yields pretty much wiped out the return of the earlier a few a long time.

10-12 months nearby forex governing administration bond yields, %

Supply: Refinitiv Datastream

South African equities (FTSE/JSE Capped SWIX) delivered a 12% annualised return above the 3 years to conclusion March. That is about 7% ahead of inflation and in line with the lengthy-expression (120-12 months) average authentic return.

Having said that, the truth is that there are extremely handful of yrs wherever fairness returns line up with the historic ordinary.

The regular is made up of blockbuster many years, adverse decades, and several years when almost nothing a great deal transpires. But normal decades are unusual.

This implies that you want to stay invested in excess of several yrs to benefit from the fantastic several years when they take place. This also indicates that you need to sit by the terrible a long time, due to the fact we can not forecast which years will be superior or negative.

This is significantly genuine of neighborhood stated house returns. Inspite of attaining 26% more than the previous 12 months, the a few-yr once-a-year return of the FTSE/ JSE All Residence Index is -4%. This compares poorly to the 30-12 months normal genuine return of close to 6%.

South African bonds sent 8.5% per yr, well ahead of inflation and even with the govt losing its last expenditure quality credit rating ranking in March 2020. The July 2021 unrest also failed to meaningfully dent bond returns. Provided that the greatest indicator of long run bond returns is only the generate you pay out these days, the outlook for bond returns stays appealing, specially supplied strengthening domestic fundamentals.

Cash sector returns are connected to prevailing brief-time period interest charges. When the SA Reserve Financial institution minimize fees aggressively two yrs ago, income sector returns fell in tow. They will now abide by the repo rate bigger once again, but at this stage nonetheless lag inflation. It is also unlikely that we will return to the pre-2020 problem where by shorter-term curiosity fees had been 2% to 3% previously mentioned inflation, providing beautiful chance-free of charge real returns.

In other text, the age-aged chance-return trade-off is again.

Lastly, at the conclude of March the rand was only a little bit weaker towards the dollar compared to three a long time ago and not far from wherever it was six yrs back. The concept that the rand always falls and boosts world returns for South Africans is just not correct. The extensive-expression trend is weaker, but there can be very long intervals of sideways motion or appreciation. This needs to be considered.

In summary

The earth faced significant shocks in the previous two many years and is undergoing financial and political changes that we do not yet thoroughly comprehend. Nonetheless expense returns ended up rather superior. Investors who overlooked the sounds and trapped to their approach would have done nicely.

It is easy to get carried away with the terrible information of the second, but with modify there are always investment decision chances.

This does not suggest blindly extrapolating developments since what worked in the earlier could not function as perfectly in the long run. But currently being properly diversified, keeping an eye on valuations and being affected individual will go a long way to reaching the preferred final result.

Izak Odendaal is an investment strategist at Previous Mutual Wealth.