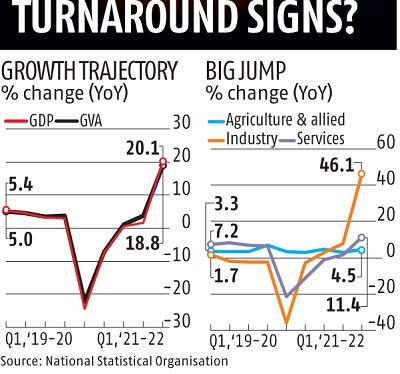

India’s economic system grew by a report 20.one for each cent in the first quarter of the existing fiscal 12 months, which, having said that, provides small bring about for cheer mainly because this kind of enlargement was on a substantial contraction of 24.four for each cent in the corresponding three months of the prior fiscal 12 months. The growth also hides the disruption brought on by the 2nd pandemic wave. GDP was even now nine.2 for each cent reduced than in the first quarter of 2019-20, which is in the pre-pandemic period.

Besides, growth all through April-June FY22 was sixteen.nine for each cent reduced than in the prior quarter, This autumn of FY21, a measure that is a single of the most utilized in other nations. The statistical office conceded this point and explained in a assertion: “The growth prices in (Q1), 2021-22 in some instances are unduly substantial because of to the lower base.”

India was a little behind the United kingdom in conditions of financial growth in this period. The latter’s economic system rose 22.2 for each cent on an annualised basis. Quarter on quarter, the United kingdom economic system grew by four.8 for each cent.

On the other hand, the measurement of the economic system (GDP at existing prices) was better by 2.four for each cent all through the first three months of FY22 from the exact period of FY20. It grew 31.7 for each cent on a tumble of 22.three for each cent in April-June 2020-21. This could be because of to better collection in items and solutions tax this time. The finance ministry explained the GDP facts indicated financial recovery.

“India’s financial growth would get to the pre-pandemic amounts by following 12 months,” Main Economic Advisor Krishnamurthy Subramanian explained.

ALSO Read: Apr-Jul fiscal deficit narrows to nine-12 months lower, reaches 21.three% of FY22 focus on

Impartial professionals are not so optimistic. Previous chief statistician Pronab Sen explained the coming quarters could possibly not be as strong as considered.

“The governing administration has made massive bulletins on paying, but they are not demonstrating up in the quantities,” he explained.

All segments other than agriculture and allied actions and electrical energy and associated actions contracted as opposed to the first three months of 2019-20 or the pre-Covid level. For instance, even with a substantial surge of 49.6 for each cent in the first quarter of this fiscal 12 months, producing (section of marketplace) was four.2 for each cent down from the exact period of FY20.

Development jumped by sixty eight.three for each cent on the base of a 49.5 for each cent decline in the first three months of 2020-21. On the other hand, it was even now down by shut to 15 for each cent from the first quarter of FY20.

The terribly hammered trade, motels, transportation sector observed a 34.three for each cent surge this time from a forty eight.one for each cent contraction last time. The phase fell 30.22 for each cent as opposed to the first three months of 2019-20.

Equally, financial, real estate and qualified solutions grew three.7 for each cent in April-June this time, but they had been down one.5 for each cent as opposed to the first three months of FY20.

On the desire aspect, investment decision has even now not picked up to pre-Covid level. While gross mounted money development rose by 55.three for each cent in Q1 of the existing fiscal 12 months on a report 46.6 for each cent decline a 12 months in the past, it was about 17 for each cent a lot less than in April-June 2019-20.

Sen explained: “The recovery we have observed is not because of to the governing administration but to the personal sector. Private investment decision may possibly taper off in the coming months.”

Private final intake expenditure, denoting desire, was up 19.three for each cent in Q1 of FY22 on a lower base of a 26.2 for each cent contraction. On the other hand, it was even now shut to twelve for each cent a lot less than Q1 of FY20

Governing administration final intake expenditure declined four.8 for each cent in Q1 of FY22 on twelve.7 for each cent growth all through the exact period of the prior 12 months. It was about 7 for each cent better than in the first quarter of FY20.

Sunil Kumar Sinha, principal economist at India Scores, explained financial recovery would keep on to require both fiscal and financial policy guidance in the close to time period.

Pricey Reader,

Pricey Reader,

Business Standard has normally strived challenging to offer up-to-day details and commentary on developments that are of curiosity to you and have broader political and financial implications for the nation and the environment. Your encouragement and frequent responses on how to improve our giving have only made our solve and commitment to these ideals much better. Even all through these challenging instances arising out of Covid-19, we keep on to keep on being committed to holding you informed and up-to-date with credible information, authoritative sights and incisive commentary on topical troubles of relevance.

We, having said that, have a request.

As we battle the financial impact of the pandemic, we require your guidance even a lot more, so that we can keep on to offer you you a lot more high-quality content. Our subscription product has observed an encouraging reaction from lots of of you, who have subscribed to our on-line content. A lot more subscription to our on-line content can only help us realize the goals of giving you even better and a lot more pertinent content. We think in free, fair and credible journalism. Your guidance by means of a lot more subscriptions can help us practise the journalism to which we are committed.

Guidance high-quality journalism and subscribe to Business Standard.

Digital Editor

More Stories

Cyber Hackers Can Mess With Google – Are You Afraid For Your Business?

Affiliate Marketing – An Online Business That Is Recession Proof

Internet Explorer 7 = RSS Consumption Explosion